INFOGRAPHIC

By the Numbers: A long-term partnership built on results

"By dual-listing on the Long-Term Stock Exchange, we are codifying the critical relationship between ThredUp and our long-term stakeholders and ensuring our success is their success.”

— James Reinhart,

CEO and Co-Founder, ThredUp

CEO and Co-Founder, ThredUp

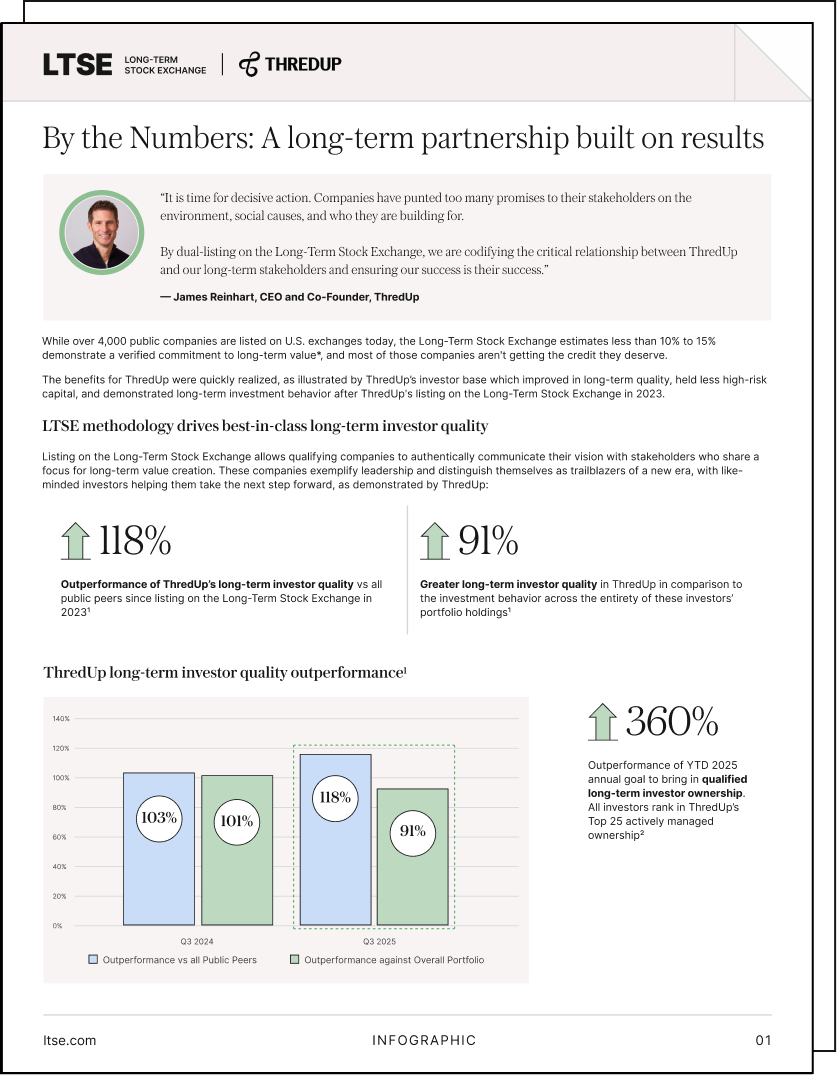

LTSE methodology drives best-in-class long-term investor quality

Listing on the Long-Term Stock Exchange allows qualifying companies to authentically communicate their vision with stakeholders who share a focus for long-term value creation. These companies exemplify leadership and distinguish themselves as trailblazers of a new era, with like-minded investors helping them take the next step forward, as demonstrated by ThredUp:

118%

Outperformance of ThredUp’s long-term investor quality vs all public peers since listing on the Long-Term Stock Exchange in 2023¹

91%

Greater long-term investor quality in ThredUp in comparison to the investment behavior across the entirety of these investors’ portfolio holdings1

ThredUp long-term investor quality outperformance1

360%

Outperformance of YTD 2025 annual goal to bring in qualified long-term investor ownership. All investors rank in ThredUp’s Top 25 actively managed ownership2

Co-branded campaigns with LTSE increased consumer action and further positioned ThredUp as a long-term company

LTSE and ThredUp collaborated on three national campaigns to demonstrate the differentiation the partnership creates among long-term values-aligned consumers.

2023 Results

270%

Outperformance on customer purchases3

267%

Lower cost-per-acquisition (CPA)3

2024 Results

1,317%

Outperformance on customer purchases4

93%

Lower customer cost-per-acquisition (CPA)4

2025 Results

28%

Outperformance on customer lift for bag requests5

338%

Lower customer cost-per-incremental-action (CPIA)5

Raised awareness of ThredUp's long-term value and leadership

405

Media outlets covered ThredUp's listing on the Long-Term Stock Exchange, including:

Sources

*Based on an internal analysis conducted by LTSE Services, Inc. in January 2024.

1. Measured via LTSE Long-Term Score℠ as applied to LTSE proprietary data-sets, FactSet, and relevant SEC filings, as of Q3 2025

2. Based on LTSE and ThredUp tracking data, as of Q3 2025

3. Statistics versus Google-provided benchmark for ThredUp X LTSE Co-branded Campaign May-July 2023

4. Statistics versus ThredUp target goal for ThredUp x LTSE Co-branded Campaign Summer 2024

5. Statistics versus ThredUp Target Goal for ThredUp x LTSE Co-Branded August 2025 Campaign

1. Measured via LTSE Long-Term Score℠ as applied to LTSE proprietary data-sets, FactSet, and relevant SEC filings, as of Q3 2025

2. Based on LTSE and ThredUp tracking data, as of Q3 2025

3. Statistics versus Google-provided benchmark for ThredUp X LTSE Co-branded Campaign May-July 2023

4. Statistics versus ThredUp target goal for ThredUp x LTSE Co-branded Campaign Summer 2024

5. Statistics versus ThredUp Target Goal for ThredUp x LTSE Co-Branded August 2025 Campaign

Disclaimer

The information contained above is provided for informational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Readers should consult their own tax, legal, accounting or investment advisors.

Many of the services outlined in this document are provided by LTSE Services, Inc. LTSE Services and its affiliates, including the Long-Term Stock Exchange, Inc., which is a registered national securities exchange under the provisions of the Securities Exchange Act, do not provide tax, legal, accounting or investment banking or investment advisory services or advice.

Companies are not required to adopt or purchase any tools or services from LTSE Services in order to apply to list on the Long-Term Stock Exchange. Companies can customize their long-term policies; however, only the Exchange’s independent regulatory staff can determine whether proposed policies meet the principles-based requirements for listing under Exchange rules.

Neither LTSE nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding LTSE-listed companies are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results.

© 2026 LTSE Services, Inc.

Many of the services outlined in this document are provided by LTSE Services, Inc. LTSE Services and its affiliates, including the Long-Term Stock Exchange, Inc., which is a registered national securities exchange under the provisions of the Securities Exchange Act, do not provide tax, legal, accounting or investment banking or investment advisory services or advice.

Companies are not required to adopt or purchase any tools or services from LTSE Services in order to apply to list on the Long-Term Stock Exchange. Companies can customize their long-term policies; however, only the Exchange’s independent regulatory staff can determine whether proposed policies meet the principles-based requirements for listing under Exchange rules.

Neither LTSE nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding LTSE-listed companies are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results.

© 2026 LTSE Services, Inc.