Symbol:

TDUP

TDUP

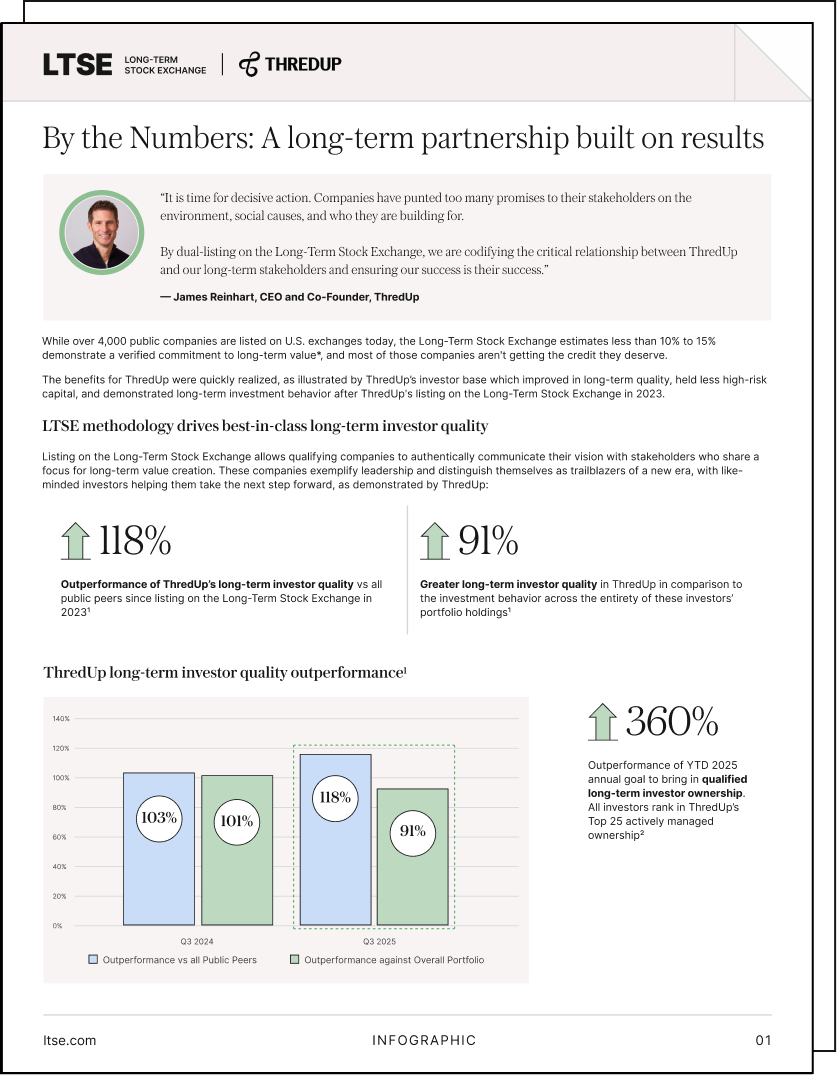

It is time for decisive action. Companies have punted too many promises to their stakeholders on the environment, social causes, and who they are building for.

By dual-listing on the Long-Term Stock Exchange, we are codifying the critical relationship between ThredUp and our long-term stakeholders and ensuring our success is their success.

James Reinhart, CEO and Co-Founder, ThredUp

ThredUp provides end-to-end resale services for sellers, including pricing, merchandising, fulfillment payments, and customer service.

As a managed marketplace, ThredUp buyers and sellers trust ThredUp to deliver value, selection, and quality.

investor relations

About ThredUp

ThredUp is transforming resale with the mission to inspire the world to think secondhand first. By making it easy to buy and sell secondhand, ThredUp has become one of the largest resale platforms for apparel, shoes, and accessories. ThredUp is extending the life cycle of clothing, changing the way consumers shop, and ushering in a more sustainable future for the fashion industry. For more information, visit ir.thredup.com.

Visit ThredUpFounded

2009

Headquarters

Oakland, CA

Industry

Retail, Fashion Resale

Symbol

TDUP

ai vision

ThredUp’s AI vision for the future of fashion resale

ThredUp takes an innovative approach to incorporating AI into fashion resale. With a vast amount of data on unique secondhand items and buyer preferences, ThredUp utilizes AI technology to enhance various aspects of its business operations and customer experience.

One key area is in streamlining its single-SKU processing in its network of distribution centers to improve throughput and productivity. ThredUp's advanced AI technologies extract a wide range of detailed characteristics of an item from its image, enriching its inventory database and streamlining the processing and categorization of items. This has improved operational efficiency and the accuracy of its product listings, resulting in better search and personalization in the marketplace.

Additionally, AI is leveraged to bring emotion and storytelling to the millions of shopping journeys that happen on ThredUp. With four million items in the marketplace at any given time, AI-powered search makes it easy and intuitive to find any secondhand item on ThredUp. Generative AI technology will soon give customers the ability to create outfits they love using text descriptions or imagery.

By harnessing the power of AI, ThredUp is able to provide an enhanced shopping experience while optimizing operational efficiency in the fashion resale industry.

One key area is in streamlining its single-SKU processing in its network of distribution centers to improve throughput and productivity. ThredUp's advanced AI technologies extract a wide range of detailed characteristics of an item from its image, enriching its inventory database and streamlining the processing and categorization of items. This has improved operational efficiency and the accuracy of its product listings, resulting in better search and personalization in the marketplace.

Additionally, AI is leveraged to bring emotion and storytelling to the millions of shopping journeys that happen on ThredUp. With four million items in the marketplace at any given time, AI-powered search makes it easy and intuitive to find any secondhand item on ThredUp. Generative AI technology will soon give customers the ability to create outfits they love using text descriptions or imagery.

By harnessing the power of AI, ThredUp is able to provide an enhanced shopping experience while optimizing operational efficiency in the fashion resale industry.

ThredUp impact at a glance

172.3M

secondhand items processed

666M lbs

of CO2e prevented

7B

gallons of water saved

1.3B

kWh of energy saved

10M

items listed through RaaS program

$6.5B

saved by ThredUp buyers off est. retail prices

ESG IMPACT

The global secondhand apparel market is expected to reach $367 billion by 2029*

“As consumers are increasingly thinking secondhand first, the retail industry is adopting powerful new pathways for resale. From the integration of social commerce and innovative AI applications to the establishment of trade organizations and interfacing with government, it’s clear why resale is seeing accelerated growth and has such a promising growth trajectory.”

– James Reinhart, CEO and Co-Founder, ThredUp

Read the ThredUp Resale Report– James Reinhart, CEO and Co-Founder, ThredUp

*ThredUp Resale Report 2025

LONG-TERM POLICIES

Better policies for greater impact

Inspiring a new generation — of buyers, sellers, brands, investors, communities, and other stakeholders — takes guts. It’s a task steeped in a long-term strategy that focuses on purpose-driven profit. Resale pioneer ThredUp is blazing a new trail in the retail industry, promoting a more sustainable, circular future for fashion.

ThredUp’s mission? To inspire the world to think secondhand first. The fashion world, much like investing, is held captive by the short term. It’s a dynamic that ThredUp is hoping to fix, as outlined in its long-term policies.

Read ThredUp’s LTSE Listings PoliciesThredUp’s mission? To inspire the world to think secondhand first. The fashion world, much like investing, is held captive by the short term. It’s a dynamic that ThredUp is hoping to fix, as outlined in its long-term policies.

ThredUp’s long-term policies

Policy 1:

Long-Term

Stakeholders

With the collective power of ThredUp's stakeholders, they’ll pioneer a more sustainable future for the fashion industry.

Policy 2:

Long-Term

Strategy

ThredUp's impact flows from a long-term outlook: engaging in medium and long-term planning that links back to their overall vision.

Policy 3:

Long-Term

Compensation

Executive and board compensation is linked directly to long-term performance.

Policy 4:

Long-Term

Board

Board membership requires a long-term commitment to social and sustainability initiatives and to stockholders.

Policy 5:

Long-Term

Shareholders

ThredUp is committed to engaging with long-term and sustainability-focused investors.

Disclaimer

The information contained above is provided for informational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Readers should consult their own tax, legal, accounting or investment advisors.

Many of the services outlined in this document are provided by LTSE Services, Inc. LTSE Services and its affiliates, including the Long-Term Stock Exchange, Inc., which is a registered national securities exchange under the provisions of the Securities Exchange Act, do not provide tax, legal, accounting or investment banking or investment advisory services or advice.

Companies are not required to adopt or purchase any tools or services from LTSE Services in order to apply to list on the Long-Term Stock Exchange. Companies can customize their long-term policies; however, only the Exchange’s independent regulatory staff can determine whether proposed policies meet the principles-based requirements for listing under Exchange rules. Exchange rules differentiate between the products and services that it can offer to prospective listed companies and those that are available to companies currently or newly listed on the Exchange.

Neither LTSE nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding LTSE-listed companies are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results.

© 2025 LTSE Services, Inc.

Many of the services outlined in this document are provided by LTSE Services, Inc. LTSE Services and its affiliates, including the Long-Term Stock Exchange, Inc., which is a registered national securities exchange under the provisions of the Securities Exchange Act, do not provide tax, legal, accounting or investment banking or investment advisory services or advice.

Companies are not required to adopt or purchase any tools or services from LTSE Services in order to apply to list on the Long-Term Stock Exchange. Companies can customize their long-term policies; however, only the Exchange’s independent regulatory staff can determine whether proposed policies meet the principles-based requirements for listing under Exchange rules. Exchange rules differentiate between the products and services that it can offer to prospective listed companies and those that are available to companies currently or newly listed on the Exchange.

Neither LTSE nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding LTSE-listed companies are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results.

© 2025 LTSE Services, Inc.