INFOGRAPHIC

Discover how listing on the Long-Term Stock Exchange delivered the results that matter most

“We have chosen to list with the Long-Term Stock Exchange (“LTSE”) to align ourselves with people and organizations that share a long-term view of our growth. We believe that a long-term philosophy is in service of pursuing our vision in a steady and persistent manner. Like all companies, we intend to create great returns for our shareholders and our goal is that those returns are a natural byproduct and a catalyst to fulfilling our mission: to help humanity thrive by enabling the world’s teams to work together effortlessly.”

Dustin Moskovitz

Co-Founder & Chair, Asana

Co-Founder & Chair, Asana

Dan Rogers,

Chief Executive Officer, Asana

Chief Executive Officer, Asana

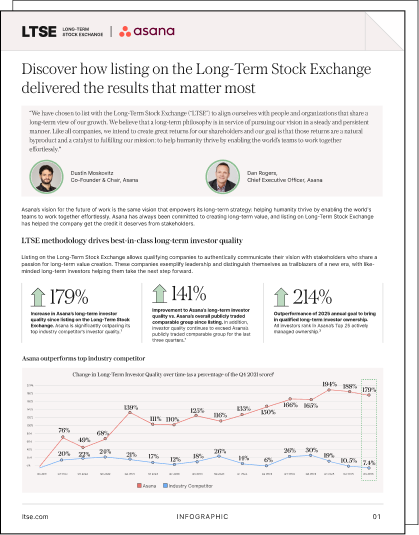

LTSE methodology drives best-in-class long-term investor quality

Listing on the Long-Term Stock Exchange allows qualifying companies to authentically communicate their vision with stakeholders who share a passion for long-term value creation. These companies exemplify leadership and distinguish themselves as trailblazers of a new era, with like-minded long-term investors helping them take the next step forward.

179%

Increase in Asana’s long-term investor quality since listing on the Long-Term Stock Exchange. Asana is significantly outpacing its top industry competitor’s investor quality.¹

141%

Improvement to Asana’s long-term investor quality vs. Asana’s overall publicly traded comparable group since listing. In addition, investor quality continues to exceed Asana’s publicly traded comparable group for the last three quarters.¹

214%

Outperformance of 2025 annual goal to bring in qualified long-term investor ownership.

All investors rank in Asana’s Top 25 actively managed ownership.²

All investors rank in Asana’s Top 25 actively managed ownership.²

Asana outperforms top industry competitor

Partnership with LTSE expanded Asana's annual recurring revenue

LTSE and Asana collaborated to establish measurable outcomes that align with Asana's long-term strategy to acquire enterprise customers.

92%

Customer Executives strongly agree/agree that the partnership between LTSE and Asana strengthens their consideration for doing business with Asana³

116%

Outperformance versus target annual recurring revenue goal⁴

Raised awareness of Asana’s

long-term value and leadership

long-term value and leadership

Sources

¹ Measured via LTSE Long-Term Score℠ as applied to LTSE proprietary data-sets, FactSet, and relevant SEC filings, as of Q3 2025

² Based on LTSE and Asana tracking data, as of Q3 2025

³ Based on Asana x LTSE Survey Data for Asana and LTSE's co-branded New York Work Innovation Summits, Executive Dinners 2023 and 2025

⁴ Based on Asana data, 2023 and 2024 for clients who attended Asana X LTSE co-branded Work Innovation Summits

² Based on LTSE and Asana tracking data, as of Q3 2025

³ Based on Asana x LTSE Survey Data for Asana and LTSE's co-branded New York Work Innovation Summits, Executive Dinners 2023 and 2025

⁴ Based on Asana data, 2023 and 2024 for clients who attended Asana X LTSE co-branded Work Innovation Summits

Disclaimer

The information contained above is provided for informational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Readers should consult their own tax, legal, accounting or investment advisors.

Many of the services outlined in this document are provided by LTSE Services, Inc. LTSE Services and its affiliates, including the Long-Term Stock Exchange, Inc., which is a registered national securities exchange under the provisions of the Securities Exchange Act, do not provide tax, legal, accounting or investment banking or investment advisory services or advice.

Companies are not required to adopt or purchase any tools or services from LTSE Services in order to apply to list on the Long-Term Stock Exchange. Companies can customize their long-term policies; however, only the Exchange’s independent regulatory staff can determine whether proposed policies meet the principles-based requirements for listing under Exchange rules.

Neither LTSE nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding LTSE-listed companies are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results.

© 2026 LTSE Services, Inc.

Many of the services outlined in this document are provided by LTSE Services, Inc. LTSE Services and its affiliates, including the Long-Term Stock Exchange, Inc., which is a registered national securities exchange under the provisions of the Securities Exchange Act, do not provide tax, legal, accounting or investment banking or investment advisory services or advice.

Companies are not required to adopt or purchase any tools or services from LTSE Services in order to apply to list on the Long-Term Stock Exchange. Companies can customize their long-term policies; however, only the Exchange’s independent regulatory staff can determine whether proposed policies meet the principles-based requirements for listing under Exchange rules.

Neither LTSE nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding LTSE-listed companies are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results.

© 2026 LTSE Services, Inc.